For all the talk of the numerous biotechnology companies with mere months of cash left and the predictions of looming liquidations, mergers, and acquisitions, it is important to note that a measure of destruction can benefit industry progress.

Economy Joseph Schumpeter coined a term for industrial progress through destruction: creative destruction. In this process, growth occurs by the development of new companies, which develop new innovations and replace older companies.

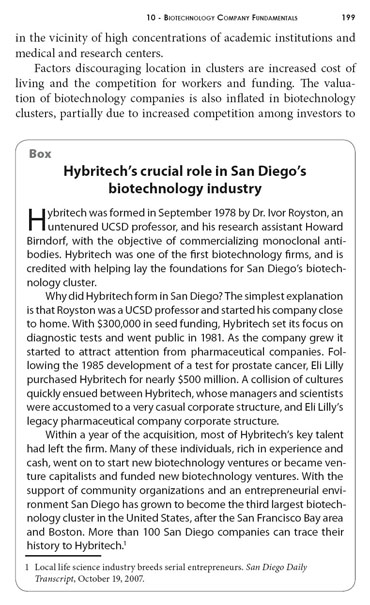

Even mergers and acquisitions can drive progress, as they free seasoned executives from their former jobs. The story of Hybritech’s key role in the development of the San Diego biotechnology cluster is a case study of this kind of growth:

Source: Building Biotechnology

So, while the process of creative destruction may be painful for those who are employees or investors in the destroyed companies, it is a natural element of business cycles, and an essential part of driving progress.